Table Of Content

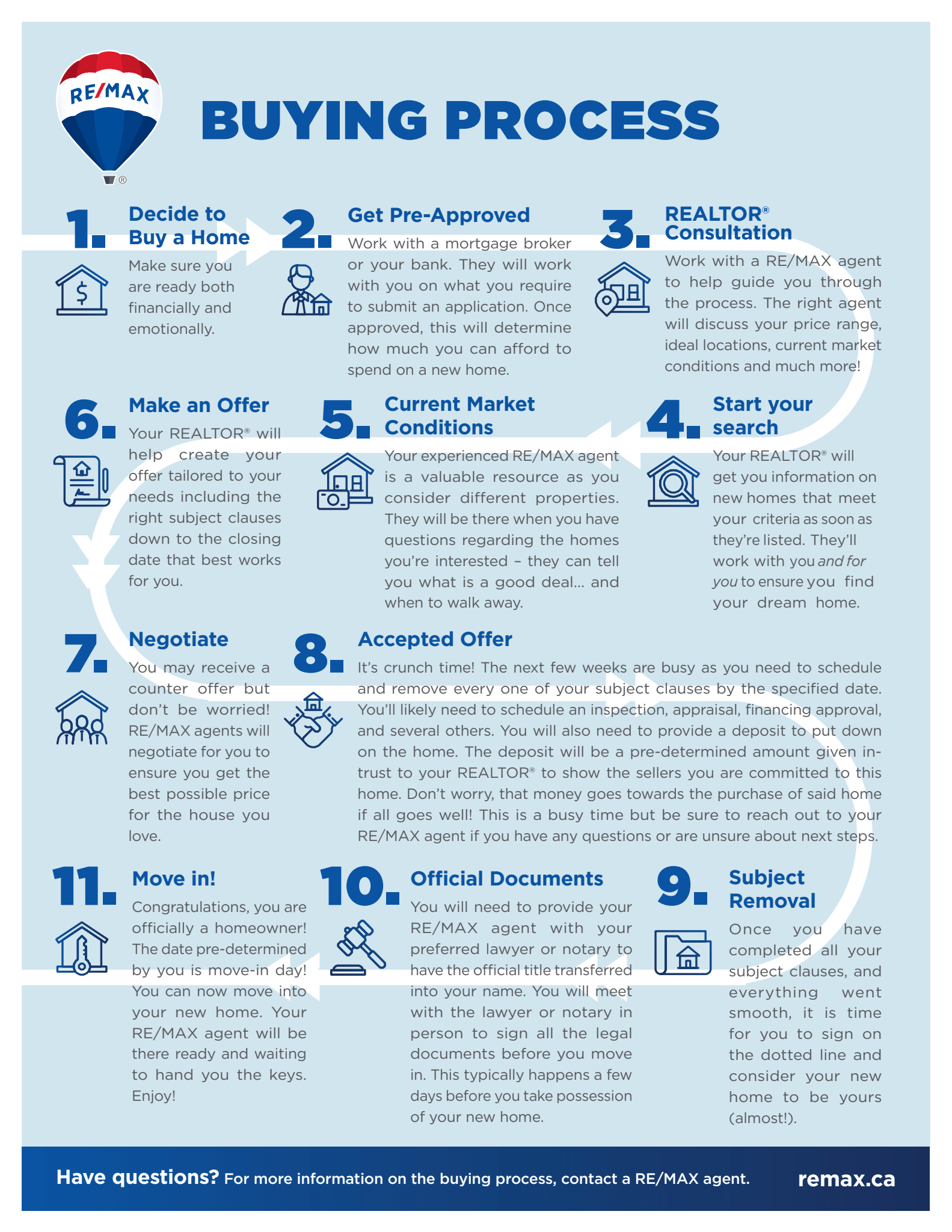

Lydia’s House, a community development nonprofit organization, helped him apply for D.C.’s Home Purchase Assistance Program. The elevated costs add to the challenges facing homebuyers amid the spring home-buying season. Real estate activity tends to pick up in the spring, as homeowners traditionally list their properties during the season and buyers venture to open houses amid warmer weather and longer days. Most importantly, you'll want to pay your bills on time each and every month.

Get the inside scoop on homebuying

It is possible one or more of these listings could have been sold or taken off the market by the time of publication. Stephanie Yaa Annor, 34, started looking for a multifamily home — where she could live while making rental income — in January 2023. She was thrilled when her offer on a remodeled home, with a separate back unit, was accepted the next month. Buying a home remains a primary wealth-building tool for U.S. households, but rising home prices have placed homeownership increasingly out of reach for the average American.

Company

It was a day like any other — the day my home was engulfed by fire. No one on earth or above asked me if I was ready for the shoulder shake. The morning started with a buzzy, two-minute car ride to my daughter’s school. It ended with us — me, my husband, our then 4-year old and 1-year-old — sharing a queen-size bed at my in-law’s house.

How to Afford a Home

It’s a good idea to make a list of your top priorities, some of which might depend on the type of house you’re looking for and whether you’re in search of a starter home or a forever home. Before you close on your loan, your lender will give you a document called a Closing Disclosure, which specifies the closing costs you’ll be responsible for and how much you’ll need to pay. Look over your Closing Disclosure carefully to know what to expect and catch any errors. Your down payment is a large, one-time payment toward a home purchase. Many home buyers believe they need a 20% down payment to buy a home, but this isn’t true. Plus, a down payment of that size isn’t realistic for many first-time home buyers.

The purchase price of the home doesn't typically have a direct impact on what credit score you'll need. However, if a higher price leads to you making a small down payment, you may need to have a better score to compensate for that. You may also need to have cash reserves to help cover your mortgage in case of emergencies. These reserves are typically equal to at least 2 months’ worth of mortgage payments. Depending on the type of loan you’re applying for and your qualifications, your lender may require more months of payments.

“We couldn’t even afford to stay in our hometown,” Sarah Shervin said. The cheapest place they saw in Jackson was an $800,000 two-bedroom condo, and that was out of their budget. The condo gives them financial flexibility to continue to travel, see shows, go out to eat — and keeps them in the city close to the beach. With each failed attempt, the couple got more competitive with their offers. For years, Jennifer Morris and Joel Cuevas, both 39, had been dutifully tracking their spending. But they had no idea what kind of mortgage they could afford, and a bank offered little advice.

Built in 1956, this three-bedroom, two-bathroom cape-style home has been renovated. It has an open-concept living room/dining room, updated kitchen and bathrooms and new hardwood floors. On the second level, there is space with a full bathroom that can be used as a primary suite, office or fourth bedroom. Built in 1939, this four-bedroom, two-bathroom cape-style home has easy access to major highways and the train station. It has a breakfast nook in the kitchen, a fully fenced-in backyard, solar panels and other energy efficient utilities. Jim Buchta has covered real estate for the Star Tribune for several years.

How Much Does it Cost to Buy a House?

Because LA is such a complex market, it’s important to find a real estate agent who can help you make sense of the real estate scene. A local agent or Realtor will have a firm grasp of how quickly homes are going to contract, which areas are seeing more or less activity and when sellers might be close to dropping their prices. At first glance, California’s average property tax can look like a bargain. However, since homes have such a high value here, your annual bill to the government can be a big line item in your budget — more than $6,000 based on median state home values.

How to Choose a Mortgage Lender

Some mortgages for first time homebuyers may not require the full 20% down. In fact, there are little to no down payment home loans out there for those who qualify, such as the VA loan for those that served in the armed forces. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

They used the equity they earned from that house to buy two rental properties. "That's what got us into real estate," said Jt Williams, who bought a big house in northeast Minneapolis several years ago with Dan Kenney, a friend from high school. More than a quarter of all potential homebuyers polled during a recent national survey by Re/Max said they were considering buying with friends or family members to help with affordability.

Kemper was dating Sean Boley, and they were living in a small house in the Hamline-Midway neighborhood in St. Paul. Combining forces made sense, as they realized they could share all the expenses — and obligations — that came with homeownership, including snowblowers and lawn mowers. “What I did was look for a little bit of a rougher house in a good area and then invest the money in doing the renovations,” Robertson said. She was the first to make an offer, and Dan loved the house when he saw it that night. The seemingly perfect house needed to be rewired, the water heater needed to be moved, the siding was collecting moisture, and it had foundation issues.

Housing Market Predictions for Next 5 Years (2024-2028) - Norada Real Estate Investments

Housing Market Predictions for Next 5 Years (2024- .

Posted: Thu, 25 Apr 2024 07:00:00 GMT [source]

"We got more excited about the idea because we realized we could get double the square footage for less than double the cost of two houses," Ohrn said. "The world is too expensive now," said Skylar Olsen, chief economist at Zillow. "People still want to access real estate to live in but also as an investment, but it's harder to access, so they will co-buy with a friend or relative."

Their real estate agent and lender also helped them analyze their savings and how much to use for a down payment, insurance and maintenance. Last year, just over 4 million existing homes sold in the United States — the lowest number in nearly three decades, according to the National Association of Realtors. Loans have gotten more expensive, as mortgage rates have more than doubled in three years and are now about 7 percent, for a typical 30-year loan. The average interest rate on a fixed 30-year home loan rose to 7.1%, marking the first time this year rates have topped 7%, according to Freddie Mac. Meanwhile, the median asking price for U.S. home — what homeowners hope their property will sell for — jumped to a record $415,925 for the four weeks ended April 21, Redfin said. A 750 score is considered a "very good" credit score, according to FICO.

Companies That Buy Houses For Cash In Michigan - Bankrate.com

Companies That Buy Houses For Cash In Michigan.

Posted: Fri, 26 Apr 2024 19:21:50 GMT [source]

Bring your ID, a copy of your Closing Disclosure and proof of funds for your closing costs. It’s common for home buyers to include a home inspection contingency in their purchase offer. A contingency gives buyers the option to back out of a purchase (or negotiate repairs) without losing their earnest money deposit if the home inspection reveals major issues. You’ll also need to pay closing costs before moving into your new home. Closing costs are fees that go to your lender and other third parties in exchange for creating your loan. You’ll need a DTI of 43% or less to qualify for most mortgage options.

And with the help of a friend's dad, who is a lawyer, they also crafted a "housing agreement," which covers most practical aspects of managing the house and living together. They share other space in the house, including an extra bathroom that's mostly for the kids. Each couple also have an additional bedroom on the second floor initially used as a guest room for each, but those rooms transitioned into bedrooms for the kids.

If you have excellent credit and a low debt-to-income ratio, some lenders will offer you conventional loan terms with a down payment of just 3 percent. However, it’s important to understand that a bigger down payment will make a huge difference in your monthly mortgage payment. On average, Olsen said, it took buyers in the Twin Cities metro more than seven years to save enough money to make a 30% down payment on a house. The credit score required to buy a house depends on your lender and the type of loan you’re taking out. You can expect to qualify for common types of home loans with a credit score of 620. But some lenders will still consider you eligible with a lower score if you exceed other criteria.